Freedom from "Income Tax"

Freedom from Tryanny: A History of My Rebellion from the “Income Tax” Illusion.

“Alice in Wonderland”

“The Matrix”

“The Wizard of Oz”

“Illusions"

Nothing is - what it seems…

My Story of Liberty begins… in Seattle, Washington 1990.

I came across a book: “The Federal Mafia” written by Irwin Schiff. Irwin Allen Schiff (February 23, 1928 – October 16, 2015) Schiff was tagged as an American tax protester known for writing and promoting literature in which he claimed the income tax in the United States is illegal and unconstitutional. Judges in several civil cases ruled in favor of the federal government and against Schiff. As a result of these judicial rulings, Schiff was serving a sentence of at least 13 years for tax crimes at the time of his death.

I was fascinated with the information Mr. Schiff claimed was the truth. I took away one highly valuable direction he stated – “If you do nothing else, DO NOT sign a 1040 Tax form.” Doing so waives your "Constitutional Rights" - which could very well send you to jail.

In 1990, I stopped filing a 1040 Tax return. Since then, many things have occurred in those 31 years. I was “flying under the radar” for 18 years until I registered to vote in the 2008 Presidential Election. The IRS began sending me letters requesting I submit and file a 1040 tax return. I stayed silent and did not respond to their requests, so in 2010 they proceeded to levy my wages by garnishment, with my employer – Wellpartner Pharmacy.

When I was told the Feds were going to take 62% of my wages from each paycheck, it was like a bomb going off – I was shell-shocked! I felt bludgeoned with fear and wanted to run… (Mexico was a viable option). I had instinctively known someday I would need to deal with 20 years of not filing income tax returns.

So here I was…ready to be swallowed up by the IRS Darkness. Instead, I was gifted with a sliver of hope and ray of sunshine. I had a conversation with the husband of my supervisor. He shared his personal tussle with Oregon’s Department of Revenue and said he had won. He advised me to educate myself by doing research, and take a stand. He did not offer to show me what he personally did to win. I began from scratch with only the idea that I could find the necessary information to dig myself out of the hole I’d stepped into since 1990…. Google became my friend and it opened up the flood gates to my education. I made the decision to enter the rabbit hole, pull back the curtain, and swallowed the “Red Pill." I am no longer asleep.

This information will show a history of my experience dealing with the IRS on a Federal level and the State of Oregon. It will show how I won the day with both.

*******************************************************

Financial Freedom - Income Tax Recovery

Action #1:

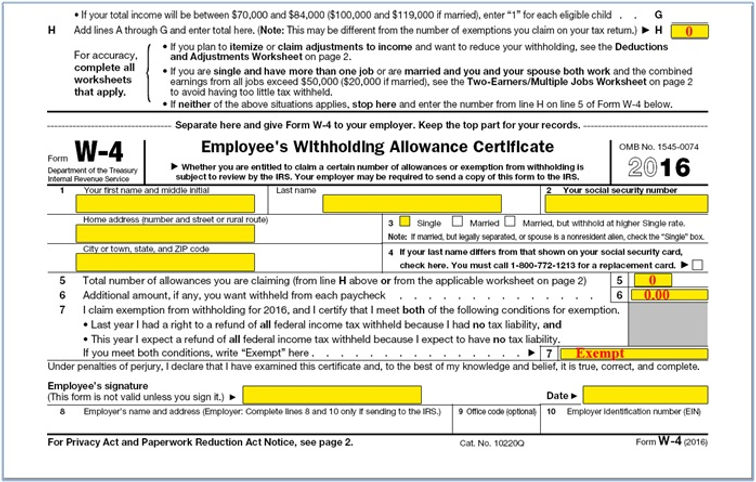

January 1st. 2017 - EXAMPLE

I fill out a new W-4 (for 2017) and submit as “Exempt” to my employer. This will prevent any Income Taxes withheld from my paycheck for the rest of the year.

Note: I will need to submit a W-4 Exempt form to my employer every year in January (otherwise it will automatically default to the highest deduction from my wages. I should submit this before February 15th of each year.)

Action #2:

(If after calculating my taxes and find I’m not getting any money back or I need to “Pay” the IRS – I would NOT FILE a Tax return for 2016.)

After calculating my taxes for 2016 and find I am owed a “Refund” I would proceed and file a 1040 Tax return for the year 2016 before April 15th and get back as much money as I can. This will be the last time I will need to bother with this process.

Action #3

Whenever I receive a Letter from the IRS (Federal or State) I will respond immediately with a response letter (See sample letters included in this packet – I make the necessary changes to the letters that apply). It is best for me to respond by 1-2 days of receiving any correspondence from them.

Notes:

If no money is taken from my paycheck in any given year, then there is no need for me to file a 1040 Form. If I file a 1040 form - I am agreeing to play the Game of "Income Tax." If I sign and submit a 1040 form - I am then liable for paying taxes - I have then agreed to waive my rights and consent to their rules.

There is no law that requires an individual (with the exception of a government employee) to file a 1040 form. In 2010 when the IRS garnished my wages (strong-armed my employer) they took $8,691.52 in 8 months.

My mistake was not responding to the letters from the IRS to dishonor their claims. Now - whenever I received a letter from the IRS, asking me to file a 1040 for any year... I respond with asking them - to first show me the law that requires I file a 1040 tax return. If they can show me the law, I would then comply. After 6 years of requests - they decided not to show me the law (since there is none) hence the two letters (posting below) stating I did no longer owe them $9,935.00 for 2013 and $7,692.00 for 2014.

In 2010 the IRS forced my hand and I began to educate myself on this matter. Hell yeah - I was scared! I learned to push forward, not by arguing the law (Never argue the law) but by asking for proof of this law.

I have been liberated because I took a stance and won.